New Product Launch: ClimateLens Monitor Yield Outlook - see regional and location-specific yields on key commodity crops, updated weekly. Learn More

Himanshu Gupta • August 8th, 2023.

The Task Force on Climate-Related Financial Disclosures (TCFD) is an international organization created to improve climate-related financial reporting. TCFD reporting disclosures aim to enhance the understanding of investors, shareholders, and the general public regarding businesses’ financial risks associated with climate change.

TCFD reports began as voluntary measures, but in countries taking global sustainability goals seriously, it’s not mandatory for many companies.

The TCFD, meaning the Task Force on Climate-related Financial Disclosures, was created in 2015 to support financial sustainability in the wake of climate change risks. In the spirit of transparency and global responsibility, companies can disclose their risk exposure in reports used internally but also by stakeholders and investors.

8 countries have adopted mandatory TCFD reporting for companies that meet certain criteria including Brazil, Japan, Switzerland, the EU, and the UK.

Companies then incorporate TCFD recommendations into their missions and operations to A) improve their climate resilience and B) assure stakeholders of their stability and financial security. Together with ESG reporting, businesses can paint a clear and hopefully optimistic picture of the way they operate and their impacts on the world around them. Both ESG and TCFD reports include governance portions; the TCFD guidelines focus on proof of oversight for those managing climate risk.

Environmental, social, and governance (ESG) reports are concerned with a company’s accountability and impacts on the environment and society around them. They include a:

The ISSB (International Sustainability Standards Board) builds on the efforts of the TCFD. Its goal is to improve internationally recognized sustainability reporting standards to provide consistent, comparable reports. Whereas TCFD recommendations focus on climate change risk, the scope of the ISSB covers broader ESG subjects like social responsibility and fair governance.

The TCFD framework covers four topics: governance, risk management, strategy, and metrics and targets. By following defined guidelines, companies can create more effective climate risk reports and display their relationships with climate risk in a clear and measurable way. These include scenario analyses for likely situations, such as a 2-degree temperature raise or the response to regulation of greenhouse gas emissions. Reports must be specific, relevant, objective, and comparable next to other companies in the industry.

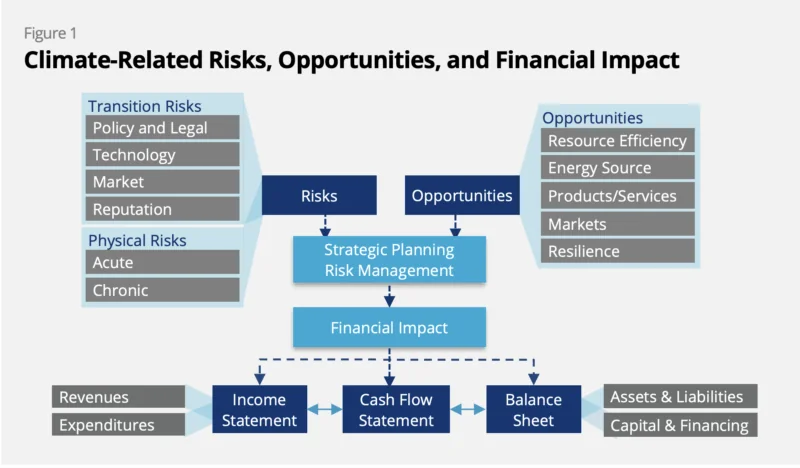

The risk and opportunity portion of TCFD reports allows companies to understand areas of exposure or potential growth. Categories include:

Governance is an overarching theme of the TCFD framework. Reports should shed light on the amount of attention that managers and executives pay to climate risk.

This part of the TCFD framework provides quantitative data regarding the actual strategy they would need to implement to mitigate risk or take advantage of new opportunities.

This could look like setting a target for greenhouse gas emissions on a timeline or supply chain diversification and the associated costs. Companies could define short, medium, and long-term horizons, categorizing risks and opportunities in each and explaining which goals they aim to complete in each and how.

This part of the TCFD framework helps to ensure the viability and objectivity of the report; the business should define how they’re measuring risk in the first place. They may address questions like:

– Which laws and regulations do you consider relevant and risk-posing?

– How do you define the terminology used to describe your risks and opportunities? i.e. What would you describe as a catastrophic claim-related event?

– Define how you measured climate risks in dollar amounts.

This part of the TCFD framework discloses how risks and opportunities were measured and how the performance of key initiatives are being calculated.

For example, if they list supply chain optimization as a climate-related opportunity, and one of the benefits is stated as reduced operational costs, they’d need to show how that was calculated. Alternatively, if they think consumer opinion will be shifting in their favor, they need to show some market data to back that up.

FEMSA always provides great TCFD reporting examples. Page 59 includes clear breakdowns of past performance, current statuses, future goals, and what they need to do to get there.

Ford’s 2021 TCFD report separates goals into categories like Electrification, Carbon Footprint, and Supply Chain. They describe an overarching goal of carbon neutrality by 2050 and interim short-term goals.

Salesforce provides a clear example of the governance TCFD framework. This report clearly describes who is involved in goal setting, how often they meet, and what happens in those meetings.

Scotiabank’s TCFD report outlines governance in a detailed, paragraph style. They mention the Risk Committee, Audit and Conduct Review Committee, and Board of Directors as all involved.

Verizon provides TCFD reporting examples for the risk management category. They define relevant physical risks like hurricanes, flooding, and tornadoes. They then describe how to protect assets from these threats.

Performing TCFD reporting on every single climate-related issue can be an overwhelming task and might not necessarily offer information that is practical for decision-making purposes. In most cases, focusing on material risks and opportunities is the most beneficial for stakeholders.

The point of TCFD reporting is for investors and banks to evaluate and compare companies. For easy analysis, align metrics and standards with common industry norms and focus on TCFD frameworks relevant to your market.

Readers don’t want to feel like they’re being confused or led astray by wordy reports and redundant explanations. Following the TCFD recommendations of remaining clear and concise facilitates stronger attention to businesses by their key stakeholders.

TCFD reports should cover tangible, real-world possibilities. Including pertinent scenarios such as supply chain bottlenecks or hurricane-caused flooding will avoid perceived inessential information and improve reader engagement.

ClimateAi’s climate risk disclosure tools streamline the process of reporting on climate risk, simplifying analysis and integrating seamlessly into your existing procedures. Efficiently screen your entire portfolio for climate risk and opportunity, formulate strategies for mitigating and building resilience against these risks, and ensure compliance with the recommendations of TCFD reporting.

Businesses without in-house research teams may have to hire outside consultants just to find the type of far-reaching data that TCFD reporting requires and to perform the calculations needed to make risk predictions. Simple reporting is just one of the many benefits of ClimtateAi’s platform, and companies using it are in a place where climate risk and resilience are ready to view every day — not just when reports are due.

Our award-winning climate resilience platform is incredibly useful for all teams from financial institutions and supply chain managers. The demand planning software displays seasonal weather forecasts that model risk exposures that could impact supply, demand, manufacturing, and transportation. Other features account for TCFD recommendations, running scenario analyses and assessing portfolio strength under taxing circumstances. Almost all of ClimateAi’s features are useful for creating TCFD reports and implementing corresponding strategies.

Evaluate your portfolio’s climate risk exposure and dive deeper into points of strength and weakness. Assess the risk of each location, predict weather events before they happen, and improve forecast accuracy with our climate change software for finance. We make it easy to complete each TCFD framework and keep stakeholders informed and aligned on key goals.

The pressure to adhere to global sustainability goals isn’t going away any time soon. The demand for climate risk reporting is on the rise, yet assessing and quantifying those risks remains puzzling. ClimateAi provides guidance and expertise on the TCFD reporting requirements so teams can produce better reports in less time. Businesses can feel confident in their reports, knowing insights are not only accurate but actionable.

Though TCFD reporting is typically done to appease stakeholders or municipalities, the findings unveiled help companies eliminate the possibility of getting hit hard by climate-related events. It also helps pinpoint how climate change may create lucrative untapped business opportunities.

Made with investors and stakeholders in mind, the TCFD frameworks simplify the process of comparing and evaluating companies. Consistent reporting makes this possible, facilitating more informed decision-making and protected portfolios.

Transparent TCFD reporting means stakeholders are aware of climate-related risks before investing, and businesses can leverage climate-related opportunities when pursuing funding.

Businesses can not only display environmental accountability but make plans to enhance it and improve their public perception.

We’re likely to see more widespread regulations sooner rather than later. Just as likely are huge financial losses for those who don’t prepare for changes in weather, consumer tastes, and emissions laws. TCFD frameworks provide clear instructions on how to cope.

Companies can utilize the TCFD framework to bolster the resilience of physical and financial operations. By conducting climate risk assessments, integrating findings into strategy planning, and investing in sustainable infrastructure, businesses can climate-proof their operations and stay in the good graces of stakeholders.

Let ClimateAi provide the insights and assessments needed to meet industry standards for your next TCFD report.