ALL NEW FOUNDATIONAL INTELLIGENCE MODEL (FICE) - Get your Insights Report Here

Alex Luna • December 18th, 2024.

From unseasonal rain in Mexico to soaring prices in Egypt, erratic weather patterns and shifting global demand are reshaping onion production.

For procurement professionals, staying ahead means more than just tracking trade flows. It also requires anticipating climate risks and adapting to an increasingly dynamic market.

India, one of the world’s top onion exporters, has faced disruptions in production due to intense heat, unseasonal rains, and abnormal weather events. These conditions lead to shortages and price spikes, compounded by seasonal surges in demand. To stabilize domestic markets, the Indian government has imposed export restrictions, such as minimum export prices. These fluctuations ripple through importing countries like Bangladesh, United Arab Emirates, and Saudi Arabia, pushing them to seek alternative suppliers like China, Pakistan, and Turkey.

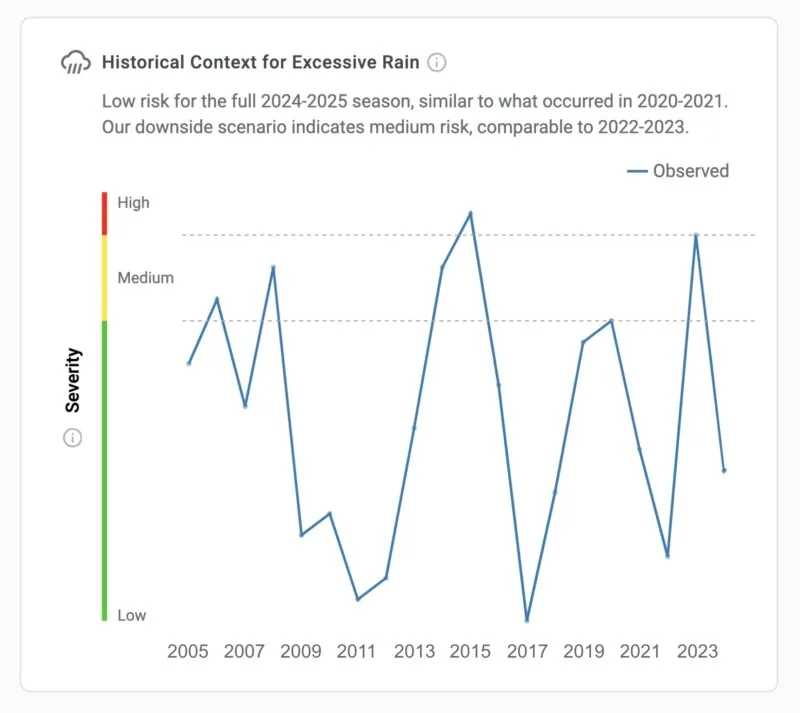

While current risks to India’s white onion production are low, historical trends underscore the vulnerability of its agriculture to extreme weather. In 2014 and 2015, unseasonal rains damaged 10-20 percent of onion, cumin, and cotton crops, driving prices to a two-year high after a preceding heatwave. Policy adjustments, including the removal of export restrictions, aimed to boost exports but failed to regain market share — exports declined by as much as 20 percent compared to the previous year. India ranked fourth among the world’s largest exporters, with countries like The Netherlands, Mexico, Spain, and Pakistan making up ground in the market.

Egypt, a key exporter to Europe and the Middle East, has faced a complex mix of challenges and opportunities in recent years. This year, factors such as open export permits, limited domestic supply, and surging demand have driven onion prices up by 150 percent, reducing the competitiveness of Egyptian exports in global markets.

At the same time, Egypt is facing heat risks similar to those during the 2021-2022 season, when dry onion yields decreased relative to the previous two years.

Last year, Egyptian onion exports to the EU more than doubled during the 2022-2023 season, reaching a four-year high. This surge was largely driven by a decline in EU onion crops caused by drought, coupled with the devaluation of the Egyptian pound, which made Egyptian exports more attractive.

However, the reliability of alternate suppliers continues to waver as extreme weather events become more frequent. Spain, for example, has faced ongoing drought that reduced onion cultivation areas by 40 percent and drove prices as high as €1.30 per kilogram in March 2023.

When supply disruptions from major exporters like India and Egypt occur, emerging players such as Turkey, Mexico, and Peru quickly adapt to meet global demand. Turkey, for instance, has ramped up exports to Gulf nations, while Peru has increased shipments to North America during supply shortages. For procurement professionals, this evolving landscape presents opportunities to establish new supplier relationships and build more resilient sourcing strategies.

Madeleine Simon is a writer and editor covering policy and sustainability.