Save your spot at Resilience in Review for Lessons from 2024 and Strategies for 2025 On Dec 11th

Madeleine Simon • December 3rd, 2024.

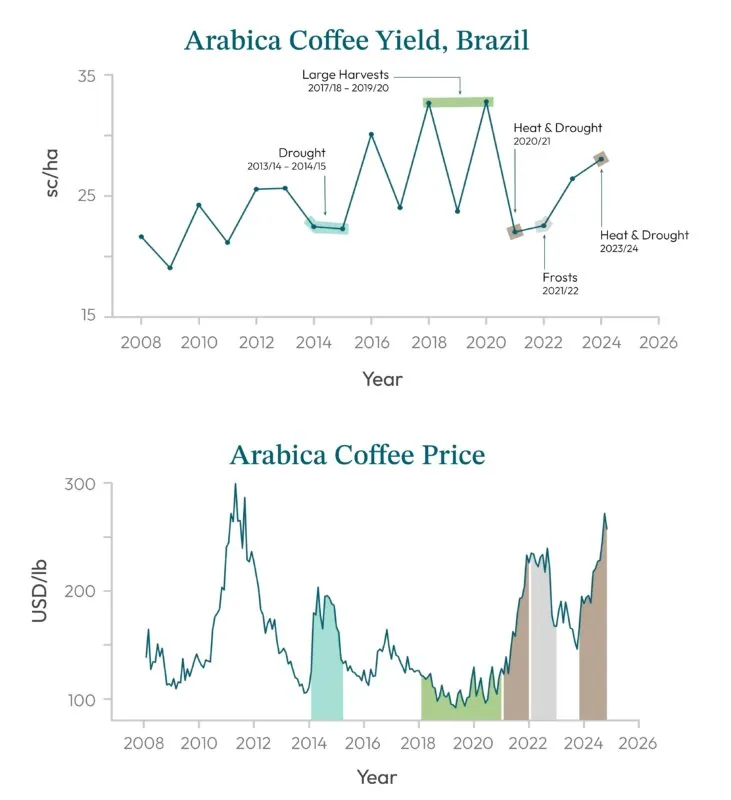

As extreme weather events become more common, coffee production faces turbulent years ahead. Rising temperatures, unpredictable weather patterns, and shifting growing seasons are destabilizing supply chains and driving price volatility.

That’s especially true in Brazil — the world’s top coffee producer — where more frequent and intense droughts, frosts, and heat waves have depleted crop yields and changed the market.

The market is becoming attuned to the effects that extreme weather events can have on commodities like coffee.

In 2015, for example, Brazil’s coffee belt was hit by one of the worst droughts in decades and crop yields dropped significantly. Prices then jumped almost 100 percent.

In the years since then, just the risk of a similar drought event has been enough to spike prices even when production is not severely impacted.

For instance, Brazil experienced a similar heat-drought event during the 2023-2024 growing season; but Arabica coffee yields in 2023-2024 remained relatively high (although the harvest was not as large as previous comparable years).

Nonetheless, prices again skyrocketed as buyers rushed to secure their supplies.

Cases such as these suggest that the market remains highly sensitive to even slight shifts in weather patterns, introducing uncertainty and spiking prices. Eventually, these costs are passed down to the consumer.

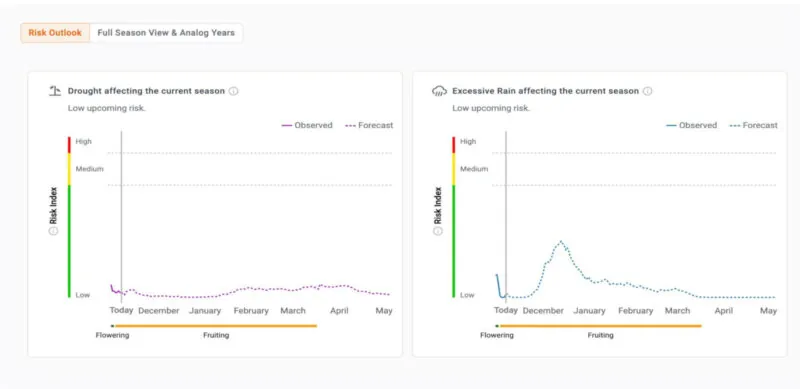

At ClimateAi, our Risk Outlook empowers companies to stay ahead of these disruptions, forecasting yield risks down to a one kilometer square in some cases.

Our climate-driven models can zero in on and control for microclimates, like those near coasts or mountains, which require a more specialized approach to ensure accuracy. This ability is especially useful when it comes to Arabica beans in Brazil, where most production is located in Minas Gerais — home to several microclimates along varied landscapes.

In the big picture, our data enable partners to anticipate adverse weather impacts, optimize decision-making, and safeguard supply chains from uncertainty.

For example, an ongoing drought this October in Brazil had markets concerned about the potential for worsening dry conditions resulting in reduced supply.

Our data indicated a medium risk of drought during this month.

However, our risk outlooks accurately predicted an easing of the drought in November — a key insight that empowers users to make informed decisions about price pressures amid subsiding weather conditions.

This information is especially helpful for the production of Arabica beans, which make up about 80 percent of Brazil’s coffee supply and are more vulnerable to climate change than its counterpart, Robusta.

During flowering, coffee plants are highly sensitive to water stress and a medium drought could cause a failure in fruit development, directly reducing the potential yield. Our ability to foresee easing drought conditions by November could be leveraged to reassure users that flowering impacts may not be as severe as initially feared.

While simulations predict that we could lose up to 50 percent of land suitable for coffee by 2050, it’s clear coffee producers are already feeling the pressures of worsening extreme weather events and face a growing need to adapt.