ALL NEW FOUNDATIONAL INTELLIGENCE MODEL (FICE) - Get your Insights Report Here

Alex Luna • June 4th, 2021.

In a year of virtual events, the one where we truly missed the in-person experience the most was the global fresh produce trade show, FRUIT LOGISTICA — you can’t beat the experience of tasting, smelling, and touching new fresh fruit and vegetables from around the world with 70,000 other agriculture professionals discussing the industry.

Luckily, we were still able to attend the virtual Fruitnet World of Fresh Ideas event last week to listen to the 60 different sessions full of lively discussion, informative presentations, and interesting perspectives. We were also honored to have the opportunity to present on how our specialty, artificial intelligence, is particularly useful for the fruit and vegetable sectors as well as some of the limitations of the technology (for free access to this video, please email media@climate.ai).

Below are some of the most interesting things we took away from the event.

1. Some good news amid a tough year: The fruit and vegetable sector is expecting to see growth in the near term, after the pandemic fostered a new consumer focus on health

As food and agriculture professionals have discussed for the last year and a half, the COVID-19 pandemic and subsequent economic shutdowns upended the world’s food supply chain.

When restaurants, bars, schools, and shops closed, produce growers and distributors quickly had to alter their operations. Nations closed borders and implemented stricter regulations. Consumers began to stockpile goods and many became wary of leaving the house.

But ultimately, despite some cracks, the food supply chain was able to emerge unbroken. Chris White, the managing director of Fruitnet, the international fresh produce publisher and events company, described the positive: “What the pandemic has shown is the incredible resilience of the food system. It’s a testament to the fact that despite COVID, business has gone on. People have gone to fields, picked produce, packed it, shipped it, and put it on shelves.”

And in particular, consumers continued to buy fruit and vegetables. In fact, many developed or rediscovered an appreciation for fresh food and cooking. Sales of avocados, the famous millennial breakfast staple, have risen over the past year, for example. Indeed, avocado leader Westfalia Fruit International’s Group Safety & Environment Executive Johnathan Sutton was in attendance discussing the fresh produce value chain. Meanwhile, health couldn’t be a more important topic — the infectious and sometimes fatal COVID-19 virus has forced people to consider the link between their health and their risk of all kinds of disease.

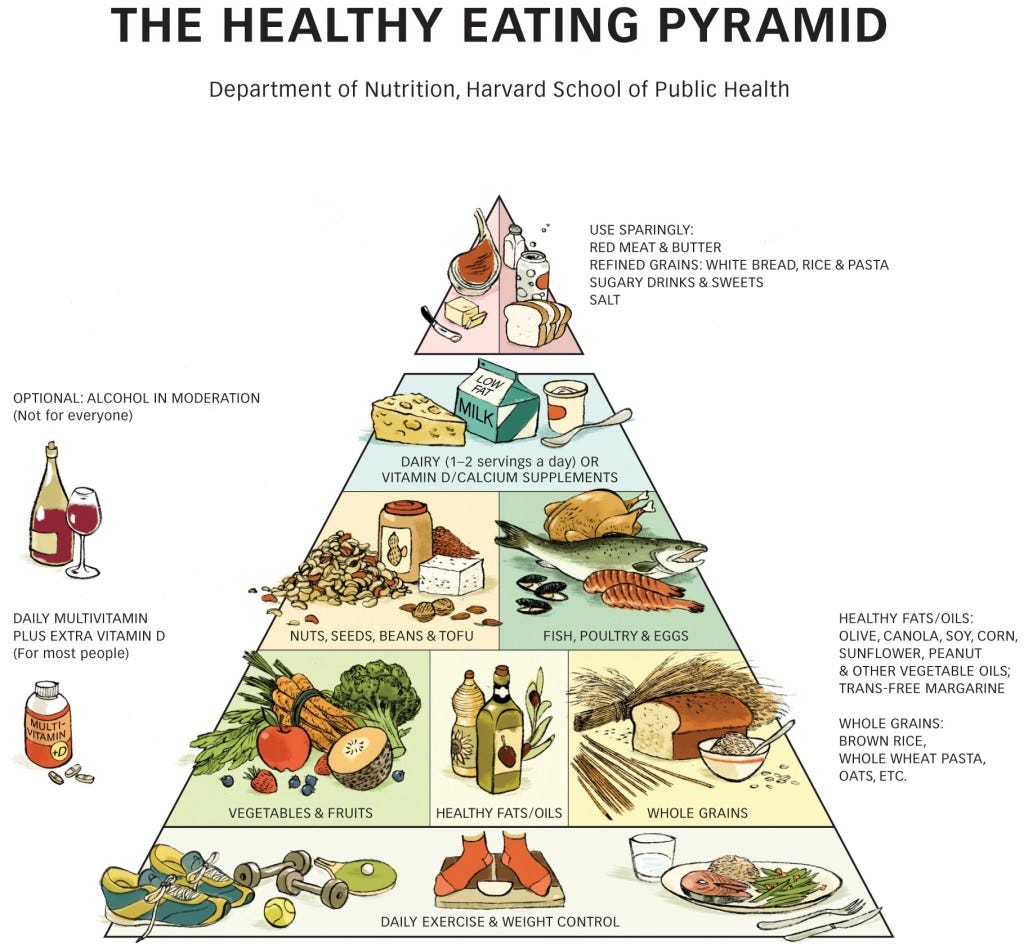

As Philippe Binard, General Delegate of fruit advocacy group Freshfel Europe, pointed out, consumers already know that fruit and vegetables can help individual health — which is both good branding and a massive opportunity for converting or upselling consumers. On average, a person needs about 400 grams of fresh fruit and vegetables (about five portions), he said. But according to studies, they’re not eating anywhere near that. In the U.S. 1 in 10 adults meet the federal fruit or vegetable recommendations, and in Europe, on average, more than half of the population reported that they consume from one to four portions of fruit and vegetables per day.

“That number [how much fruit and vegetables people currently eat] varies widely,” he acknowledged. “That is because of demographics — younger people don’t eat enough fruit and vegetables.”

“We always say, if we increase the number of fruit or vegetable by one per person per day — which is what we need [nutrition-wise] — that will mean we need 12–14 million tons to supply in the market,” he continued. “That’s win-win-win — for the sector, for health, for the government.”

Amid these trends, retailers and food traders worked hard to quickly pivot to bring their stock online to make it available to consumers. Cindy van Rijswick, the senior research analyst within the Rabobank Research Food & Agribusiness team, said that we’re at the tipping point of e-commerce and digitization, which have come into play as big factors in the food landscape and will remain big players. Bryan Roberts, industry veteran and founder of produce consultancy Shopfloor Insights, mentioned that big British retailer Tesco was able to double online capacity in 5 weeks at the beginning of the pandemic.

Even as there seems to be light at the end of the tunnel for the pandemic, van Rijswick pointed out many people will remain working from home (at least an extra day or two a week), which will have an impact on consumption/food service.

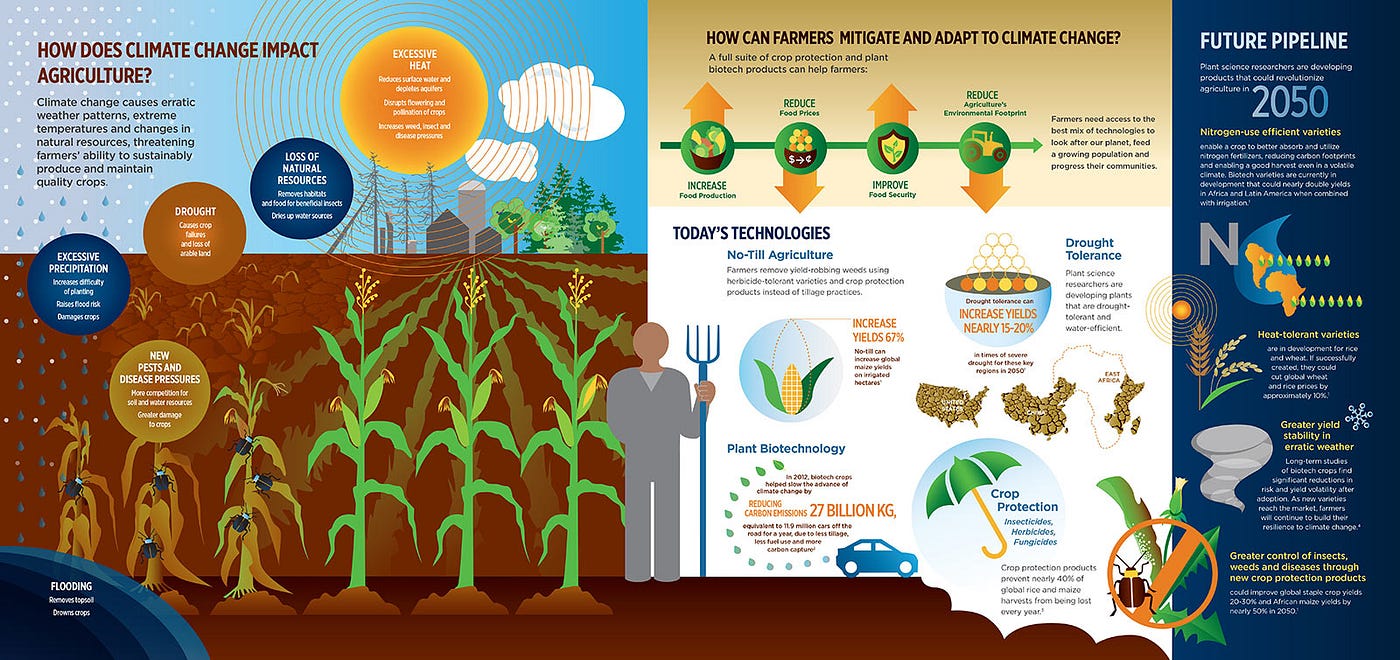

2. It’s not just human health, it’s also planetary health: concerns over climate change are already impacting the sector and driving changes in business decisions.

Sustainability is a present and growing concern among those across the agricultural value chain. Companies are increasingly turning to sustainable practices, from organic farming to more efficient logistics, to stay resilient in the face of the impacts of climate change, such as extreme weather events and soil degradation. Agriculture in particular is a unique situation: the impacts of agriculture will affect the productivity and yield of crops (differently depending upon crop and location), but certain agricultural practices also contribute to global warming.

Many companies at the World of Fresh Ideas have not just beenthinking about climate change, but have been taking action and telling their stories.

Stephan Andrae, COO of betterECO GmbH, discussed how the farmers he works with at betterECO, a sustainable, ethical B2B procurement platform, view climate change: they can’t ignore it. Ultimately, he sees climate change as a force that is already moving markets.

Binard of Freshfel agreed, and discussed how taking on climate change is an industry-wide challenge. “We could be faced in the future with adverse climate conditions and a health crisis like the one we have today,” he said.

For companies, telling a sustainability story is crucial to connect and market to modern consumers, who care about the environmental impact of their food.

Take companies like major Dutch produce distributor Eosta, leading American berry company Driscoll’s, and Westfalia Fruit International, which are all pursuing sustainability strategies.

Eosta has increased its organic and fair trade offerings, and also launched new consumer-facing educational campaigns. Volkert Engelsman, the CEO of Eosta, discussed how the company has living wages for fruit pickers and is developing benchmarks with IDH and others around the world with Central Africa and South America suppliers in mind.

“We do ask for a premium but it’s for our customers to help, and it seems to be hitting a nerve in a market,” Engelsman said.

The company’s mission of “healthy, fair and organic … is backed up by point-of-sale campaigns to help consumers make more informed purchase decisions and allows retailers to compete not just on price but on impact,” he added.

Driscoll’s in the meantime is also exploring new technology that could help with the impact of land-use and food waste, while providing customers with fresher fruits and vegetables. The company recently teamed up with Plenty, an indoor vertical farming company.

“For perspective, at Driscoll’s, we’ve been at this for over 100 years,” said Scott Komar, Senior Vice President of Global R&D for Driscoll’s. He explained that Driscoll’s has four berries: strawberries, blackberries, raspberries, and blueberries, in 22 countries with 350 million consumers. Over that time, the company has explored and adapted many different growing systems.

“We’ve always been curious, as technology has innovated, can we find something that’s closer to where our customers are? Even in major cities? So we’ve had an eye in this vertical farming for a while,” he said. “The technology is quite clever, and they’ve established a lot of intellectual property, so we thought this could be a great partnership.”

Westfalia Fruit International’s Johnathan Sutton described how the company was working towards its ambitious sustainability targets. “As a custodian of agricultural land around the world, we feel it’s our duty to be more responsible for the environment we operate in,” he said. “The idea is, we need to measure where we are today [first].”

In the past year, the company established its baseline and identified the biggest areas of improvement. For example, the company already has 9,000 hectares around the world of uncropped land that serve as carbon sinks, Sutton said.

3. The fresh produce sector is not a monolith, and each type of fruit and type of farmer faces unique challenges from production to retail. However, industry-wide collaboration is crucial to solve its largest problems.

The fruit and vegetable sector is a large, encompassing space, and might seem like one large industry. But it’s far from it. While the apple and banana might get top billing, everything from Slovenian cherries to African pineapples to California strawberries were on the lineup.

Each produce segment faces unique problems, but industry-wide collaboration lifts all boats.

As Hannes Tauber, the Marketing Director of Italian apple cooperative VOG South Tyrol, described: “What we see is that food is indeed a universal language. It’s spoken all over the world. The nuance is different [by location], with different recipes and habits.”

He described how VOG’s star apple, called the Marlene, is branded as the “daughter of the Alps.” But he added that elevating the entire category of apples is equally important to Marlene’s success as branding the individual type.

“It’s important to understand the other brands in your category, but never lose focus on consumers,” he advised. “And retailers are your partners. So make sure you share values.

“We see that varietal innovation — if it’s done strategically with a clear concept and vision — has the massive potential to reach new consumers and engage existing consumers.”

Binard of Freshfel also spoke of the interdependence of the industry when he discussed how fruit and vegetable companies were approaching sustainability. “Our industry is almost a role model for how sectors can cooperate and industry can speak,” he said. “We have strength in numbers. We depend on the grower, the grower depends on us. That’s not the same as the meat industry or anything else.”