ClimateLens 2.0 is Here → See what’s new

Alex Luna • February 4th, 2025.

Cocoa is more than just a beloved treat—it’s a cornerstone of global economies, particularly in top-producing regions like Ghana and Côte d’Ivoire.

Yet, as intensifying weather patterns continue to alter growing seasons, the cocoa industry is facing supply chain challenges and significant price fluctuations.

Here’s a closer look at cocoa’s rising costs and what may be on the horizon in the coming years:

Cocoa trees thrive within a specific range of temperature and moisture conditions, making them particularly vulnerable to the intensifying climate shifts seen today.

In late 2023, for example, Ghana and Côte d’Ivoire experienced heavy rains that reduced yields and led to the development of black pod disease and plant rot. This was followed by droughts typical of El Niño in early 2024. Cocoa is particularly sensitive to drought, and the drastic weather contrast undermined crop health, exacerbating crop damage and loss.

In February 2024, Ghana reduced its cocoa crop forecast by 40 percent from its initial 820,000 metric tonnes target for the 2023-2024 season.

Economically, a recent report from the Energy and Climate Intelligence Unit (ECIU) revealed staggering results: by early March 2024, the price of cocoa beans surged to an unprecedented high of over $7,000 per tonne—nearly three times the price in March 2020. Cocoa became more valuable than oil by weight, according to the ECIU.

This extreme weather is not unique to 2023.

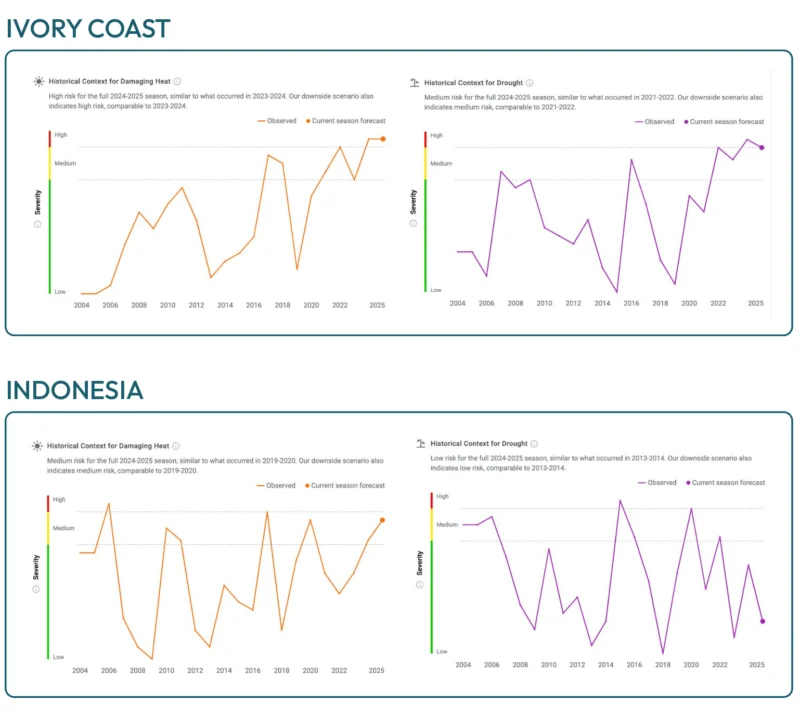

Data from ClimateAi shows that heat and drought risks in Ghana have steadily increased over the past two decades, with future seasons expected to bring similar challenges. Ghana has cut its outlook for the 2024-2025 growing season by 5 percent, according to Bloomberg. This is inline ClimateAi’s projections of droughts and damaging heat posing a medium risk to crops.

Côte d’Ivoire faces similar risks, with significant heat expected in the upcoming season and a medium risk of drought until the middle of February.

ClimateAi’s Risk Outlook can help procurement professionals make informed decisions in response to these shifting weather events.

Cocoa, like many commodities, is traded in futures contracts, where prices are determined based on anticipated supply and demand rather than immediate physical exchange. Increasing climate risks to production means greater costs for buyers. Forced to pay more for cocoa, chocolate companies have adopted various strategies to maintain profitability — overall, passing the price on to consumers.

For instance, Lindt & Sprüngli, Barry Callebaut, and Mondelez (Cadbury’s parent) responded by raising prices to offset higher production costs in 2024. Lindt saw a 7.8 percent growth in organic sales and expects continued profit margin expansion, while Barry Callebaut reported a 22.6 percent revenue increase, despite flat sales volumes due to cocoa price hikes. But, these companies could face limits from additional price hikes.

Cadbury faced backlash after a 37.5 percent price increase for Mini Eggs. Hershey experienced a decline in stock prices in November and a decrease in profits. These insights demonstrate how cocoa’s volatility continues to strain the chocolate industry, forcing manufacturers to rethink pricing and product offerings in order to maintain profitability without alienating consumers.

Smallholder farmers also face a twofold impact: reduced yield output and rising farming costs. Low profit margins for farmers may even prevent them from implementing management practices that can advance crop resilience and productivity — efforts that would aid industries across the supply chain — according to some reports.

Nearly all cocoa globally is grown in countries that are the most vulnerable to worsening climate impacts, according to the ECIU, but are still the backbone of the global cocoa trade.

In 2023, 58 million kilograms of cocoa beans worth £127 million were imported to the UK directly from these regions, according to the ECIU report. Côte d’Ivoire alone accounted for 85 percent of all cocoa beans imported to the UK. Similarly, the US imported nearly $740 million worth of cocoa and cocoa products from Côte d’Ivoire and $145 million worth of cocoa beans from Ghana the previous year.

While the risks in Ghana and Côte d’Ivoire remain moderately high, countries like Ecuador and Indonesia could emerge as larger sources in the global cocoa market. ClimateAi’s Risk Outlook can help businesses closely monitor these players, providing insights into supply chain adaptation amid threatening conditions in West Africa.

Ecuador’s cocoa production, although not immune to climate stress, has so far faced relatively lower risks on yields from extreme weather events like droughts and heatwaves. Still, ClimateAi data does show an upward trend in damaging heat and drought risks — underscoring how today’s extreme weather impacts nearly every growing region. The Risk Outlook tool can help industries stay ahead of extreme weather-related volatility.

Similarly, Indonesia’s cocoa industry faces somewhat fewer climate-related threats compared to Ghana and Côte d’Ivoire. For instance, Côte d’Ivoire has experienced increasing risks from excessive heat over the past decade, reaching its peak in the 2024-2025 season. Similarly, drought risk has steadily risen and is now only 2.2 points away from becoming a high-severity threat to cocoa yields.

Madeleine Simon is a writer and editor covering policy and sustainability.