If you like this article, sign up for early access to our ag-finance intelligence updates. Once every 2 weeks, we send our top customers in agriculture finance a biweekly climate-business intelligence briefing like this one. We are opening it up to a limited pool of public readers, so email us at media@climate.ai to sign up.

The world is watching as the Taliban consolidates control of the Afghanistan government and economy, and the question on everyone’s mind is: how did this happen?

Climate change is one large yet often overlooked part of that question’s answer.

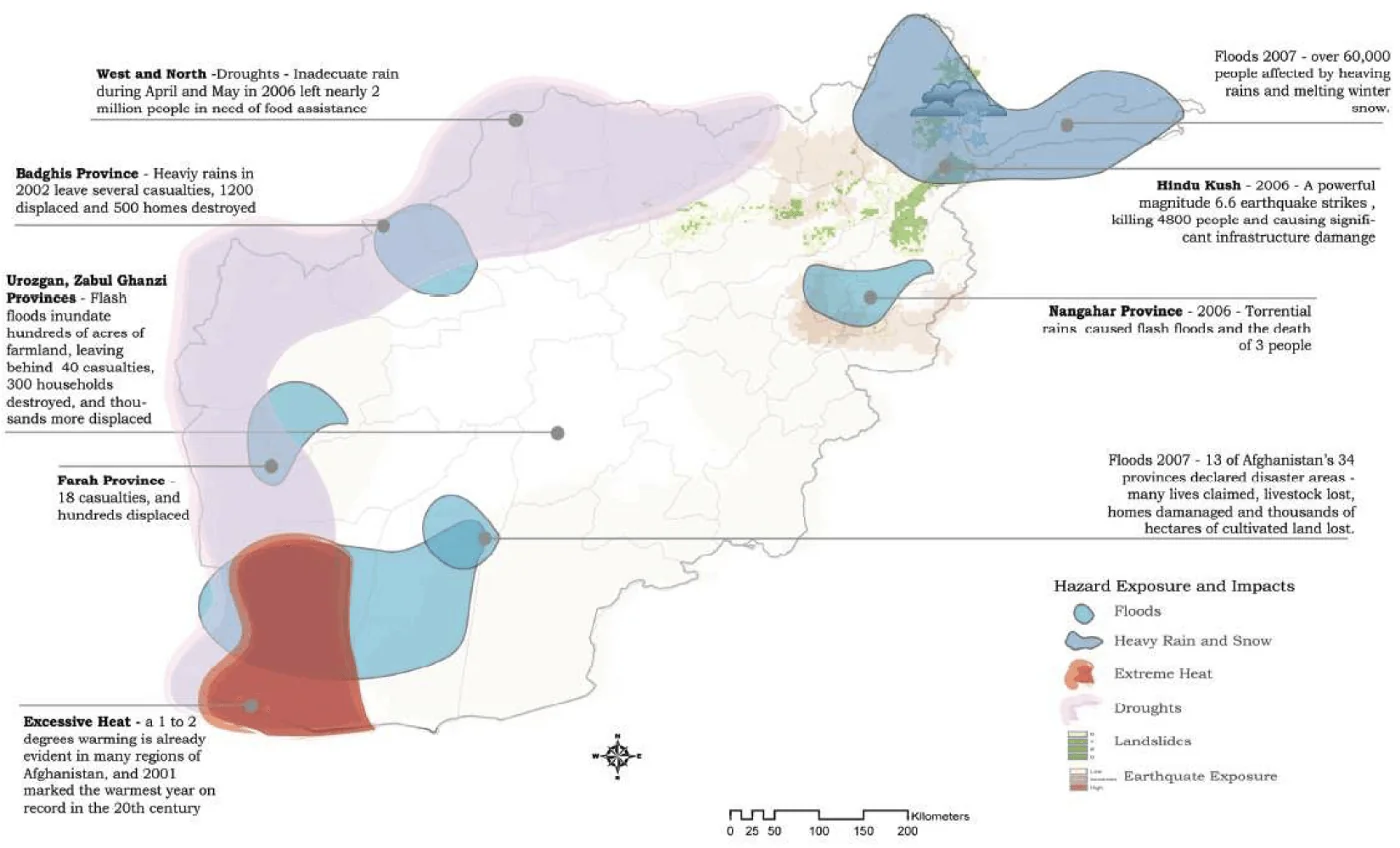

The impacts of climate change in Afghanistan are already evident: parts of the mountainous and desertic country have warmed twice as much as the global average, which, in turn, has accelerated snowmelt in the highlands resulting in damaging floods. Concurrently, spring rains have declined in regions with important farmland. Drought now threatens much of the country — more than three million Afghans are likely to be acutely affected by drought this year, which would be worse than the 2.2 million hurt by the region’s devastating 2018 drought.

All of these factors spell disaster for the nation’s farmers and residents — the United Nations says that one-third, or 12.2 million, of all Afghans face so-called “crisis levels” of food insecurity. The impoverished nation couldn’t afford to fight hunger, climate change, and the Taliban.

Source: UNEP

With a void in services and stability, the poorest and most vulnerable to climate change (those dependent on natural resources, such as small-scale farmers) may turn to illicit activities. In Afghanistan, those include poppy production and insurgency. For example, Afghan farmers could earn $5-$10 more a day fighting for the Taliban than they earn cultivating climate-vulnerable subsistence crops.

Pre-9/11, the Taliban rose as a political Islamist group during the power vaccuum created by the Soviet withdrawal in the late 1980s (and so did the militant organization it incubated, Al-Qaeda).

Then, the 9/11 terrorist attack happened, and mass global financial destabilization resulted. In the short-term, stock markets plunged, seeing a $1.4 trillion loss in market value; insurance losses were ~ $40 billion; share prices of airlines and plane manufacturers plummeted, and tourism and hospitality took hits. Gold and oil rallied. While the markets rebounded within a few months, however, long-term fallout included the reshuffling of the global insurance market, the flow of trillions of U.S. federal dollars to homeland security and the wars in Iraq and Afghanistan, and increased surveillance of financial services to monitor illicit activities.

Even for low probability events, climate change is a risk multiplier

9/11 was a “black swan” risk event — extremely low probability, extremely high impact. But climate change is a risk multiplier. It magnifies the likelihood and impact of unforeseen and unaccounted for threats across political and economic lines. These unknowns are what have created waves in investment markets in the past and will continue to create them in the future.

20 years later (to the week) after 9/11, the U.S. has offcially exited Afghanistan and the Taliban is back in power. Meanwhile, the climate crisis continues to have disastrous impacts on the local population, contributing to continuing negative economic impacts: the erosion of the banking sector and credit markets and increase in terrorism financing, money laundering, evasion of economic sanctions, narco-trafficking, and corruption.

It is clear that climate change does not happen in a vacuum — its impacts are intrinsically linked to the economic and security concerns that are at the top of government’s priorities and have lasting implications for investment landscapes, both locally and globally.

At ClimateAi, we set out to climate-proof investments and protect mission critical supply chains from climate change. Still, some impacts of climate change remain far too unpredictable, nuanced, and complicated for existing models to even attempt to predict with any level of efficacy.

ClimateAi builds tools and insights for public and private sector actors to increase the climate resiliency of mission-critical assets and processes. Whether it is understanding where the next geopolitical crisis might arise, where the world’s next bread basket is likely to be sewn or how diversified your investment portfolio really is — ClimateAi has tools to get you to a valuable answer.