Andy Paterson • June 13th, 2025.

The Iberian Peninsula is an important region for many of the world’s crops. For some specialty tree crops, like almonds, olives, and oranges, it is a globally important producer and one of the world’s largest exporters. Spain, for example, produces more than 50% of the world’s olive supply.

Both Spain and Portugal also produce a significant amount of tree nuts and citrus. Almonds and oranges are particularly important. However, as the Iberian Peninsula warms and extreme droughts kick in and Portugal and Spain’s climate changes, some tree crops are recording some of their lowest yields, especially in Southern areas.

While these climate risks represent a challenge for tree crops, they could also be an opportunity. With long-term, accurate climate intelligence, growers, investors, and procurement professionals have the data they need to make critical business decisions.

This article will explore the climate risks and opportunities facing the Iberian Peninsula as climate changes, as well as what businesses can do to adapt and build resilience.

Most research puts the Iberian Peninsula as a critically exposed region to climate change. With precipitation expected to fall as much as 20% by 2100 under certain scenarios, and temperatures expected to rise by as much as 5°C, which will have a knock-on effect on both countries in the peninsula’s tree crops.

The Iberian Peninsula is already a water-scarce region. With a warming climate comes droughts, which are expected to further reduce the groundwater levels that Spain and Portugal depend on to grow crops, with 40% of wells expected to reduce by a metre or more by 2100 under some scenarios.

This will impact all crops, but the most affected tree crops are olives and tree nuts:

As some of these regions become untenable for producers of certain crops, they may have to change the type of crop they grow to one more suitable to the changing climate. For investors, procurement professionals, and producers with the resources to move, there are new opportunities elsewhere in the region.

Forward-looking producers, investors, and sourcers, with the help of climate adaptation tools, are already experimenting with expansion into these areas.

While high-level reports of available regions indicate these areas for potential new growing regions, they fail to capture the nuances of microclimates, crop variety, and water rights that will truly determine resilience.

Water scarcity and climate risk are reducing yields for most tree crops in Iberia and are shifting growing zones, changing the growing, procurement, and investment landscape.

Businesses will need access to accurate and highly localized data that has a long lead time to make data-driven decisions on where they should be investing and to build effective adaptation plans.

As climate volatility continues to make some growing regions untenable for certain tree crop varietals that have historically been there for centuries, growers and investors will have to work on ensuring they have access to water and new resilience varietals to ensure their land is still able to produce the same tree crops it has been. Or they will have to look at new areas to fulfill their needs.

As climate risks accelerate and the impact on the yields of certain tree crops grows, sourcers, investors, and growers will have to adapt to build resilience. This three-step process is how they can begin:

Before you can adapt, you need to understand the threats. Conduct a climate risk analysis to assess crop-specific vulnerabilities and the potential impact of warming trends, the availability of water, and how extreme weather events will evolve over time across key locations. This helps pinpoint which areas are most exposed and require priority attention.

Once risks are identified and prioritized, take these two actions in order: if 2a. Mitigate Risks at Specific Investments or Existing Assets is unsuccessful or not cost-effective, explore 2b.:

|

2a. Mitigate Risks at Specific Investments or Existing Assets |

2b. Evaluate Strategic Levers |

|

Adaptive investments (e.g., drought-resistant infrastructure, new crop varieties, water storage solutions) |

Use climate analogs (locations with similar future climate conditions) to explore alternative growing regions |

Bring it all together in a comprehensive climate adaptation playbook. This includes a cost-benefit analysis of the identified climate risks and adaptation measures, alongside a formal plan for implementing adaptations. The goal is to embed climate adaptation into your broader operational and strategic planning, making long-term resilience a competitive advantage, not just a cost.

Whether you are an investor looking for signals, growers looking to find better-suited crops for their land, or procurement professionals looking for the next viable region to source your crop from, ClimateAi’s data enables you to make business-critical decisions well ahead of the competition.

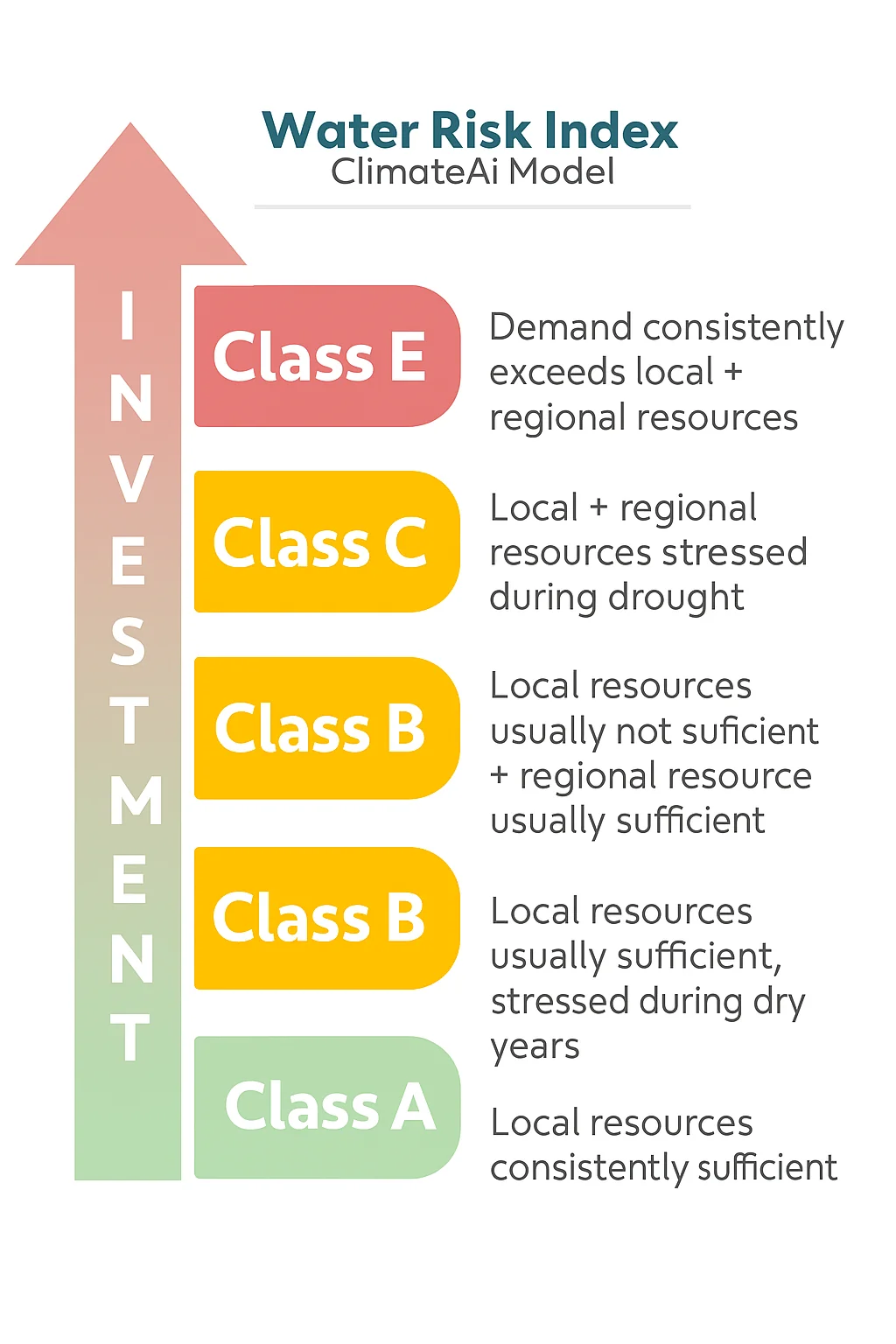

For example, our Water Risk Index for investing, classified from A-E, gives agriculture investors a clear indicator of how each investment is exposed to water risks, enabling them to understand their exposure at a glance.

From a procurement professional’s perspective, we can help you understand the level of risk the crops you care for are at of having high or low yields, to help you make sourcing decisions.

Climate change threatens Iberia’s role as a leader in tree crop production, but also opens up some new opportunities in cooler, previously underutilized regions where tree crops have not traditionally been grown.

As droughts and extreme heat-driven yield losses continue to accelerate, we’re already seeing ripple effects in supply chains and pricing, especially for premium products like extra virgin olive oil. For buyers and investors, sourcing decisions and long-term contract planning will need to evolve as Iberia’s role in global tree crop markets becomes more volatile.

To get the data, you need to make those critical business decisions on where and when to invest in and source crops. ClimateAi can support you every step of the way.

Andy Paterson is a content creator and strategist at ClimateAi. Before joining the team, he was a content leader at various climate and sustainability start-ups and enterprises.

Andy has held writing, content strategy, and editing roles at BCG, Persefoni, and Good.Lab. He has helped build one of the industry’s most popular newsletters and regularly publishes environmental science articles with Research Publishing.