Andy Paterson • May 30th, 2025.

Speciality oils, like olive, avocado, and coconut oil, have grown in popularity in recent years. While the supposed health benefits have increased demand for these oils, supply has struggled to keep up, increasing prices.

Droughts, heat waves, and other climatic factors have increased the prices of olives, avocados, and other crops used to create specialty oils. These mounting climate risks have pushed the price of olive oil in some olive-growing regions up by as much as 300%. As climate trends continue to accelerate, businesses will have to have solid adaptation plans in place to ensure they can remain cost-competitive and meet rising demand.

This article will explore the climate risks facing these specialty oils and how to build climate resilience into your procurement strategy.

Specialty oils are often niche, premium, or health-driven vegetable fats. They usually have some sort of nutritional value not found in other oils or a certain property, such as a high smoke point.

As diets turn to healthier fats, demand for these oils has skyrocketed in recent years. Using Avocado oil as an example, the industry is expected to grow by 7.5% compound annual growth rate through to 2032, when it will be a $billion industry.

However, as demand for these oils surges, the supply has been hit with reduced yields due to increased heat, drought, and other climate trends. Here are some reasons that exposure matters to specialty oils:

As global temperatures increase in the coming years, it will inevitably have an increasingly large impact on the yield of crops used for specialty oils, most of which are susceptible to drought and extreme heat. Every oil will be impacted in differing ways:

Olive oil is one of the most sought-after global oils because of its health properties and flavor. Most (~95%) of the world’s olives and olive oil are produced in the Mediterranean. Mainly coming from Southern European countries. Spain alone produces 50% of the global supply.

With so much olive oil supply restricted to one area, climate shocks, prices, and yields can be impacted by excessive heat and droughts across southern Europe, which in 2023 caused olive oil prices to surge more than 130%.

A growing body of research points to climate change having an overwhelming impact on olive yields in the 21st century, further pushing up prices.

Avocado oil has grown in popularity in recent years. While its popularity has increased demand and prices, climate-related supply shocks have also played a role in increased prices.

The majority of avocados for oil are produced in Chile and Mexico. The US gets 90% of its avocados from Mexico, with the cost of oil closely related to the cost of the fruit. Any yield reduction in Mexico causes price increases in the US. In 2025, for example, a drought caused avocado prices to almost double.

While there is a large domestic supply of avocados, mainly from California (90%), climate change is predicted to reduce avocado yield in California by more than 40% by 2050.

Coconut oil is another oil gaining prominence due to its health properties. The majority of coconuts for oil come from Southeast Asia, with the Philippines producing more than 40% of the global supply.

Coconuts are usually grown in tropical coastal areas, making them prone to saltwater intrusion from sea-level rises, the impacts of cyclones, and droughts. In 2016, for example, global coconut oil prices increased 80% when the Philippines reduced exports by 11%, as it experienced an El Niño-driven drought and a particularly strong cyclone.

With climate-related shocks making coconut prices the highest ever in 2025 and the U.S. being the largest import market globally, sourcers will have to adapt their strategy to ensure supply continuity and low costs.

Other specialty oils, like palm oil, sunflower oil, and others, face both similar and unique climate risks that have to be adapted to.

Sourcing leaders looking to buy specialty oils should expect supply volatility to increase in the coming years as yield and supply chains are impacted by climate change.

Having a climate adaptation plan for your company’s critical crops will be essential to ensure supply continuity and price competitiveness.

Climate change is creating a new baseline of price and supply volatility, one that demands better tools, faster insight, and proactive sourcing strategies. Procurement teams need to model risk before it’s priced in.

All of these factors considered, there are some key steps procurement leaders can take to mitigate their risks and increase their exposure to climate opportunities:

Early warning of how the climate will impact the yield or supply chain of your crop will be essential for short-term planning. As suitable regions of specialty oil crops change in the coming years, knowing where the next source of your avocados, olives, or coconuts is coming from will be key to your long-term planning.

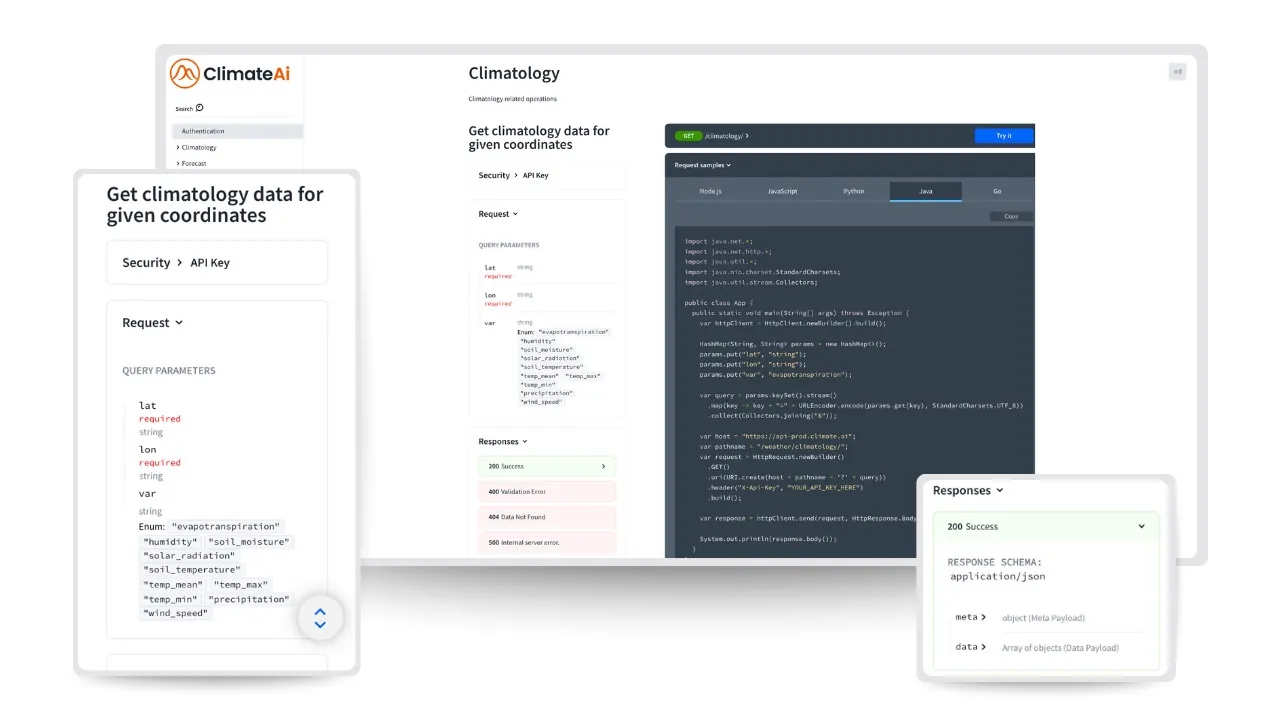

Access to ClimateAi’s API or platform ensures you have the information you need to make data-driven decisions, build a winning adaptation strategy, and ensure you can continue supplying your products at a reasonable price.

Specialty oils are growing in popularity in a more health-conscious world. Just as demand is increasing, supply is at risk from increasingly frequent and severe droughts, heat waves, and other climate-related events.

Companies that adjust now can maintain the amount, quality, and price of their supply to meet growing demand. Weather intelligence is one way businesses can ensure they have resilient, well-adapted supply chains.

Andy Paterson is a content creator and strategist at ClimateAi. Before joining the team, he was a content leader at various climate and sustainability start-ups and enterprises.

Andy has held writing, content strategy, and editing roles at BCG, Persefoni, and Good.Lab. He has helped build one of the industry’s most popular newsletters and regularly publishes environmental science articles with Research Publishing.