Zoom Webinar with Live Q&A on Dec 10th, 11:00 AM PT — 2026 Climate Adaptation Playbooks → Register Here

Alex Luna • December 3rd, 2024.

Coffee is the most traded food and beverage commodity across global markets. In recent years, coffee drinkers have seen a sharp increase in the cost of their espresso. While multiple factors, including inflation and supply chain disruptions, play a role, climate change has been one of the biggest drivers of cost fluctuations.

Due to coffee’s limited geographical range and very specific climate needs, climate change is already having a massive impact on yields and prices. By 2050, global climate change could make 50% of the land currently used to produce coffee unviable.

Continue reading to discover how coffee is impacted by climate change today, how risks will grow, and what growers and sourcers can do to adapt using climate insights and intelligence.

Coffee, particularly the Arabica varietal, which accounts for 60% of the global coffee supply, requires very specific climate conditions.

Coffee has a very limited temperature range, requires a lot of water, and grows better at altitudes above 2,000 feet. Due to this, the range of coffee is limited to within the “coffee belt,” between the tropics of Capricorn and Cancer.

As climate change makes rainfall more erratic, bringing floods followed by droughts, and increasing temperatures, global yields are already falling, which is pushing up prices. Prices for coffee commodities reached $4 per pound for the first time ever in early 2025.

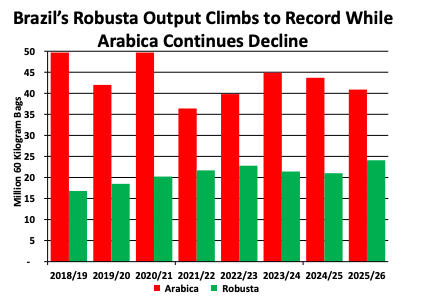

Two bean varieties make up 99% of the global supply, Arabica (60%) and Robusta (39%). Each will fare differently under climate change.

Coffee grown under hotter temperatures or pushed into areas that are less suitable for coffee growth also increases the risk of pests, fungi, and disease.

Overall, climate change is expected to have a profound impact on coffee yields and prices. Coffee sourcers and growers who start adapting today will build more resilient businesses.

After years of droughts and extreme weather events that have lowered global yields and supply, the 2025/26 season is likely to be a record-breaking supply year.

Record-breaking yields in markets like Ethiopia and Uganda have offset losses in South America, and record Robusta yields are compensating for Arabica yield losses, all of which is making late 2025 and 2026 a good year for sourcers.

However, 2026 is an anomaly. Recent years have been plagued by climate extremes, including extreme rainfall, typhoons, and high temperatures. The 2024/2025 season, for example, was marked by droughts in two of the largest producers, Vietnam and Brazil, which account for more than 50% of the global supply, causing global prices to spike. In Brazil, the world’s top coffee producer and exporter of Arabica, the worst drought in 70 years reduced yields in early 2025 by as much as 12%.

Due to Brazil’s significant impact on global coffee supply, any yield reductions there will have a substantial effect on global prices, as illustrated by the graph above. In 2014, for example, Brazil’s coffee belt was hit by one of the worst droughts in decades, resulting in significant declines in crop yields. Prices then jumped almost 100%.

And in the future, studies indicate further yield reductions and subsequent price increases, as the majority of Brazil’s coffee growers are smallholders and lack the resources to adapt and build resilience.

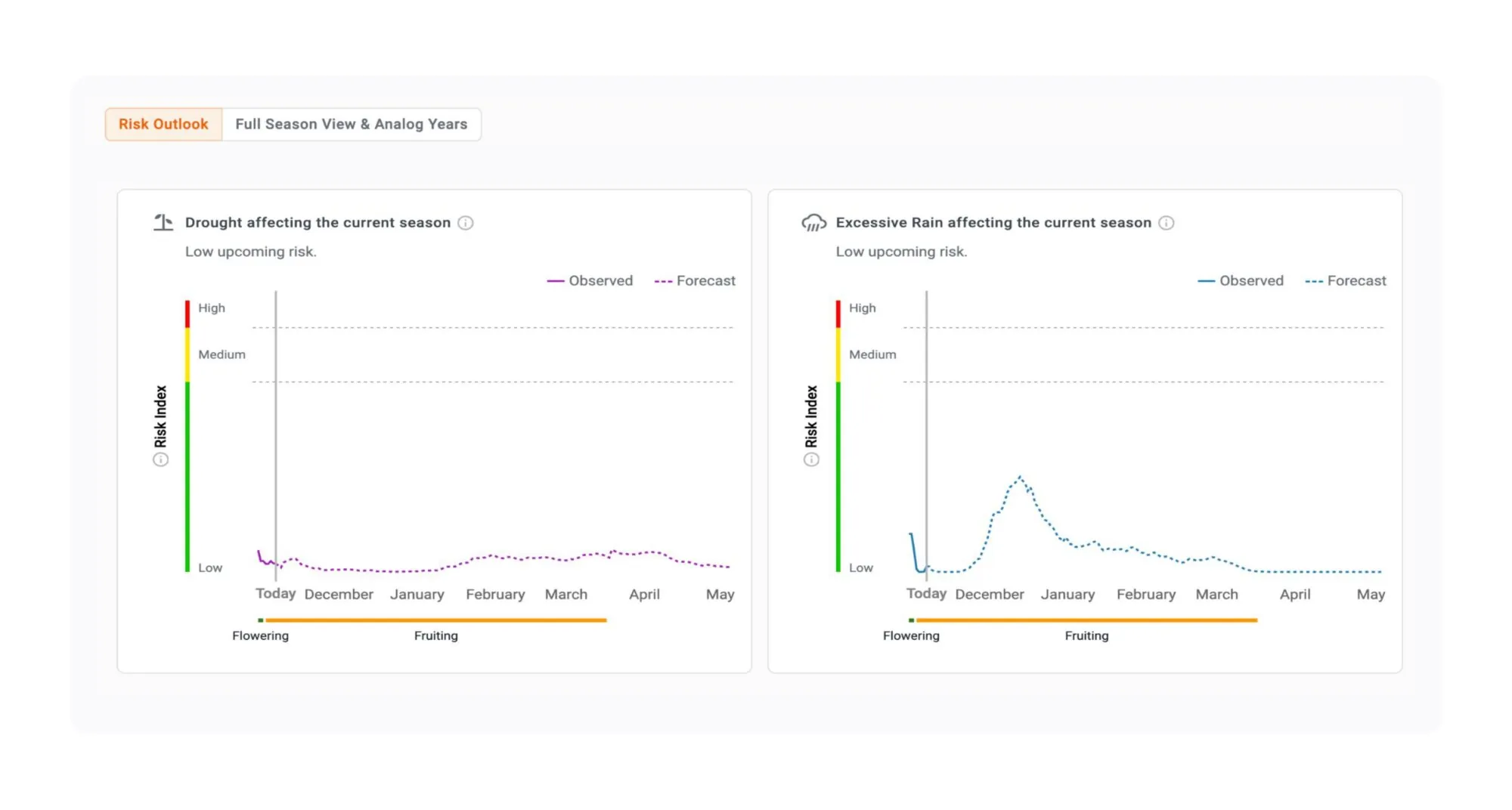

At ClimateAi, our Risk Outlook tool empowers companies to stay ahead of climate volatility by forecasting yield risks down to the microclimates, ensuring location-specific accuracy. This ability is especially useful when it comes to Arabica beans in Brazil, where most production is located in Minas Gerais — home to several microclimates along varied landscapes.

We predict a low risk of yield loss in the 2025/ 2026 growing season. But, historically, our data has accurately predicted impacts that shaped how growers and procurement professionals anticipate and react to adverse weather impacts, optimize decision-making, and safeguard supply chains from uncertainty.

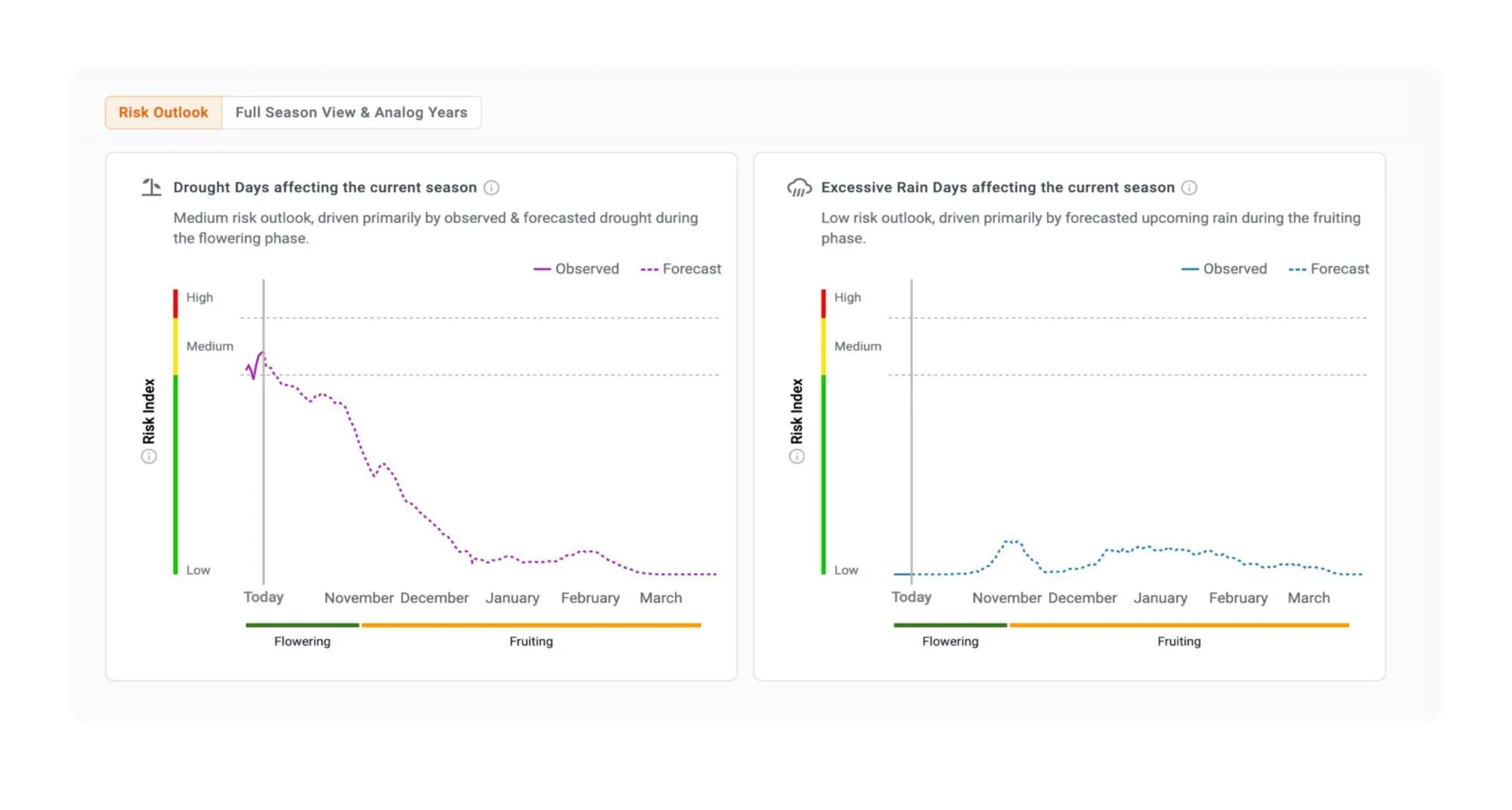

For example, a drought in Brazil last October (2024/25 season) had markets concerned about the potential for worsening dry conditions, which could result in reduced supply.

However, our risk outlooks accurately predicted an easing of the drought in November — a key insight that empowered users to make informed decisions about price pressures amid subsiding weather conditions.

This updated risk assessment for drought and excessive rain indicated a low risk to Arabica Coffee yields in Brazil during the fruiting stage.

During the fruiting stage, coffee plants are highly sensitive to water stress, and a medium risk of drought could have caused a failure in fruit development, directly reducing yields.

Our ability to foresee easing drought conditions by November could have been leveraged to reassure users that drought conditions would not impact flowering as severely as initially feared.

Even the threat of climate disruption can impact global coffee prices. In June 2025, forecasts of potential frost in Brazil’s key coffee-growing regions sent coffee prices up despite no actual damage occurring.

ClimateAi’s Risk Outlook platform accurately flagged this from the start. By combining multiple global weather models with local terrain, crop-stage sensitivity, and humidity data, our system consistently showed a low probability of damaging frost in the region.

While traditional tools flagged a high chance of frost risks, ClimateAi helped our customers’ procurement teams see through the headlines and avoid costly overreactions.

ClimateAi’s Risk Outlook delivers precise yield risk forecasts by crop stage and region.

There is no doubt that climate change will significantly impact where coffee is grown and how much, pushing up costs. Global tariffs are adding another level of complexity, with the world’s largest supplier, Brazil, facing a 50% tariff, making its coffee less economically viable in the U.S. market.

Growers today are already feeling the economic impacts of reduced yields and their land becoming less viable for coffee. These issues are set to accelerate as global temperatures increase, and forward-thinking growers and procurement professionals are taking the following steps to prepare.

While simulations predict that we could lose up to 50% of land suitable for coffee by 2050, it’s clear coffee producers are already feeling the pressures of worsening weather trends and events.

To reduce price volatility, growers and sourcers will need to adapt. One of the best ways to do this is to understand how the weather will affect yields and growing stages in the upcoming season and over the long term.